Federal Reserve Chair Jerome Powell appears cautiously optimistic about the outlook for inflation in the United States despite data on the personal consumption index (PCE) for February released on Friday, March 29 by the Bureau of Economic Analysis.

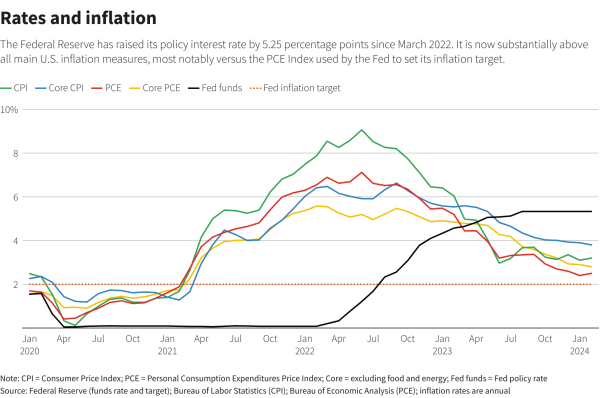

The PCE (how consumers spend on durable and non-durable goods and services) rose 2.5% year over year in February, compared to January’s 2.4% yearly PCE index. The PCE index dropped from 0.4% to 0.3% from January to February.

Excluding volatile food and energy costs, February’s yearly PCE index rose 2.8% and dropped from 0.5% to 0.3% from the preceding month.

From January to February, the PCE price index (used by the Fed to calculate inflation) rose 0.3%. Though prices jumped, according to Powell, the Fed believes it’s nothing to worry about.

“It’s not as low as most of the good readings we got in the second half of last year, but it’s definitely more along the lines of what we want to see,” said Powell during an interview on Marketplace.

In remarks after the Federal Reserve’s policy meeting during the third week of March, Powell stated that while inflation was higher than expected in January and February, the Fed is still aiming to bring inflation down to 2.4% this year, followed by 2.2% next year to hit its target of 2% by 2026.

Inflation nowcasts modeled by the Federal Reserve Bank of Cleveland estimate that monthly inflation for March will feature disinflation compared to January’s elevated rates, coming in at 0.34% for CPI and 0.25% for PCE. Excluding food and energy prices, predictions come in at 0.31% and 0.23% respectively.

Current projections by the Fed point toward a 4.6% interest rate by the end of 2024, a significant drop of more than three-quarters of a percentage point from current rates. The Fed expects to meet six more times in 2024.

The March Consumer Price Index figures will be released on April 10 and will play a notable part in the next Federal Open Market Committee meeting on May 1. Most FOMC officials and the market currently expect no change in interest rates at the conference, but the CME Fedwatch Tool reports that market expectations have pinned the probability of a quarterly drop to a 500-525 target range during FOMC’s June 12 meeting at 56.2% as of April 1.

Economist Mark J. Higgins says that the CPI report likely won’t have as great of an impact on the Fed’s decision as some fear. “One month is not going to make a huge difference in monetary policy,” Higgins said in an interview with The Beacon. “What the Fed needs to see is a reliable, durable trend of inflation […] It’s not one data point, it’s a series of data points that are consistently in the right direction.”